Signature loans give you a way that is flexible borrow funds for pretty much any function.

On line financing has managed to make it easier than ever before to have a signature loan, but this particular borrowing has its own benefits and drawbacks.

Here’s what you’ll need to find out about signature loans before you sign the dotted line.

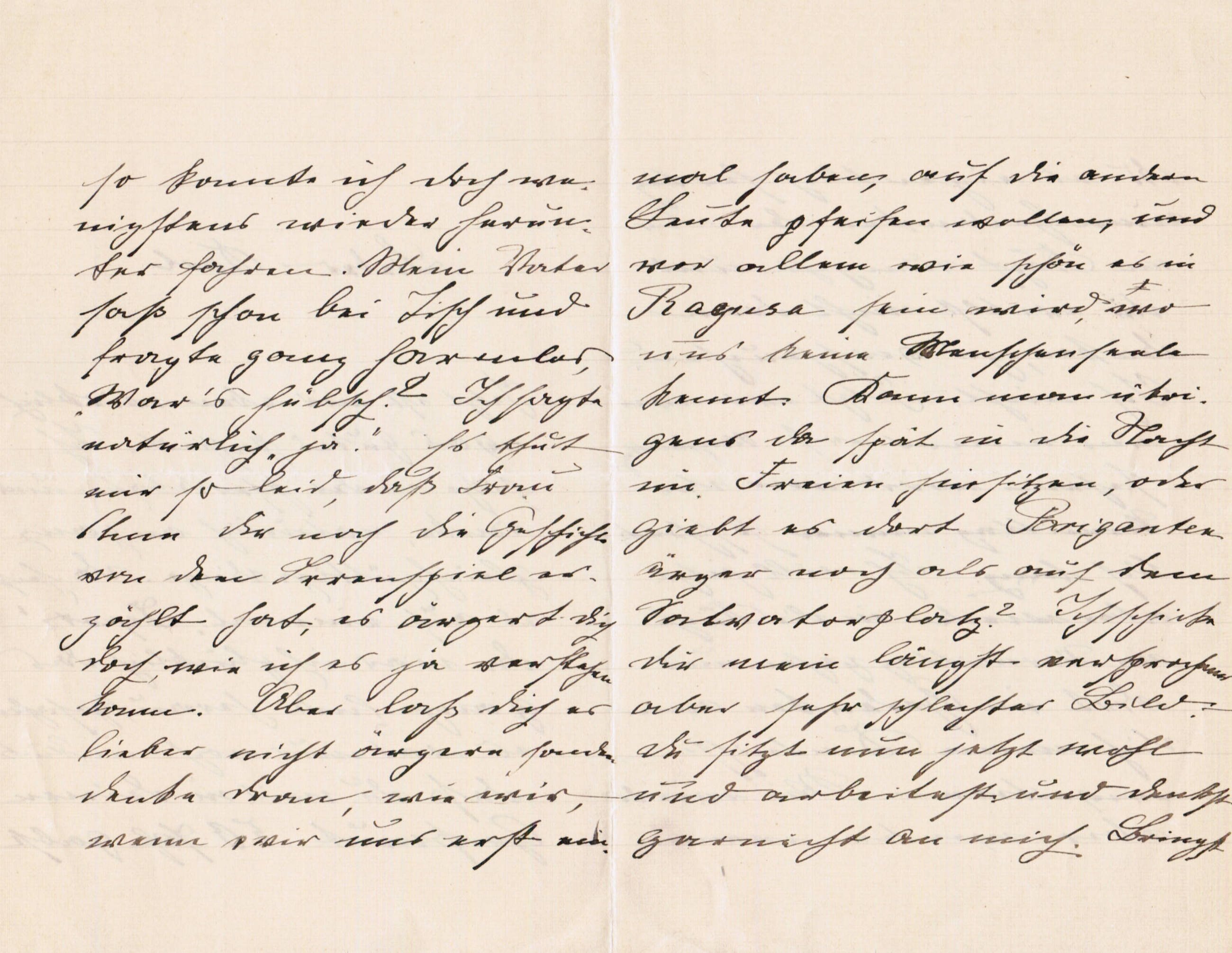

copyright: Olivier Le Moal / bigstock

In this specific article :

What exactly is a signature loan?

A signature loan is just a kind of unsecured loan that doesn’t utilize collateral. Rather, the borrower’s signature represents a vow to pay for.

This sort of unsecured loan can also be known as a good faith loan or even a character loan.

Signature loans advantages and disadvantages

A signature loan may or might not be the choice that is right some circumstances. Here are a few advantages and disadvantages to think about before finding a signature loan.

- Fast approval means it is possible to usually get the loan funded in only times.

- Signature loans can nearly be used for any purpose.

- You can easily usually qualify despite having bad credit.

- Rates of interest tend to be less than charge cards.

- Fixed interest levels make re re re payments predictable.

- Repayment terms could be years.

- Signature loans are unsecured, so that the lender won’t repossess any such thing if you miss a repayment or two.

- Rates of interest tend to be greater than with secured finance.

- Origination charges may be expensive.

- Some signature loans have penalty for very very early payment.

- Monthly premiums can be more than with charge cards.

- Belated payment charges could be expensive.

- Belated payments or defaults impact your credit rating.

- A court can be got by the lender judgement if you default from the loan.

Just how do signature loans work?

Because signature loans don’t usage security, your credit score plays a role that is big the way the loan is organized.

Your credit rating can influence the total amount you can easily borrow, the length of the loan, additionally the rate of interest.

Quantities available

Whilst the quantity you can easily borrow having a signature loan ranges from $1000 as much as $50,000 or higher, both your credit score as well as your income may play a role in determining simply how much you can easily borrow.

Borrowers with greater credit ratings can be authorized for bigger quantities, whereas borrowers with lower credit ratings might be regarded as greater dangers.

Your debt-to-income ratio can additionally influence the quantity you qualify https://speedyloan.net/uk/payday-loans-nfk to borrow.

Fixed payment term

Unlike charge cards, signature loans make use of fixed payment term.

Repayment terms commonly range between 1 year to five years. But, some loan providers offer longer terms, with a few offering that is even loans.

Expect your credit rating to impact the amount of your loan. Longer terms may just be accessible to borrowers with greater credit ratings.

Rates of interest

Your credit rating additionally impacts the attention price for the loan.

Borrowers with exceptional credit can be eligible for prices between 10 and 13%, while some may earn reduced prices.

Rates for typical credit can approach 20% and prices can go beyond 20% for borrowers with a credit history that is troubled.

Getting a signature loan

Obtaining a signature loan is generally a process that is quick but there are many actions to simply simply take before you use.

Just like significantly, take some time you must understand the print that is fine the mortgage.

While using is a fast procedure, don’t let the whirlwind speed enable you to get swept up in a loan that is perhaps perhaps not right for you personally.

- Compare loans and will be offering very carefully. Don’t assume all loans are the same. Interest levels, terms, and charges can differ, therefore spend some time in selecting the right loan. Keep in mind, you might get loan for quite some time. Pick the loan term and gives that fits your long-lasting requirements.

- Gather your write-ups. Some key documents or numbers to proceed with the loan for most loans, you’ll need. Attempt to have the after documents handy:

- two years of tax statements

- Paystubs or any other proof earnings

- Papers for any other loans, including monthly premiums and balances that are remaining

- Charge card statements

- Bank statements

- Education loan statements

- Submit an application for a loan – but rush that is don’t use. See the conditions and terms very carefully. In the event that loan does look right based n’t on costs or even for various other explanation, you are able to nevertheless check around.

- Get the loan. As soon as you’ve been authorized for the signature loan, the mortgage is frequently funded within 1-2 times. frequently, loan providers can deposit the mortgage funds straight into your money.

- Repay the loan. Most of the time, you can generate a much better price in the event that you subscribe to automated monthly obligations. Whether you will be making handbook payments or automated re payments, make sure to keep sufficient cash in your account to pay for the re re payment. an underfunded banking account may cause selection of charges and produce financial havoc that affects more than simply your signature loan.

займ moneymanзайм честное слово личный кабинетзайм на карту 100000 рублей